santa clara county property tax collector

Monday Jul 25 2022 206 AM PST. Read an overview of the administration of property taxes and the collection and distribution of taxes.

Masks are optional for visitors of County facilities but are strongly encouraged.

. Property owners who occupy their homes as their principal place of residence on the lien date January 1st and each year thereafter are eligible. San Jose CA 95110. What information do I have to give to you before I can access the data.

Enter Property Address this is not your billing address. Due Date for filing Business Property Statement. To pay Property taxes for Secured property you will need your Assessors Parcel Number APN or property address.

ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or implied including but not limited to the implied warranties of merchantability and fitness for a particular purpose. County Assessor Lawrence E. District Attorney Jeffrey Rosen.

See how 1 assessed-value property taxes are distributed. This translates to annual property tax savings of approximately 70. You can pay tax bills for your secured property homes buildings lands as well as unsecured property businesses boats airplanes.

95020 - Street. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax.

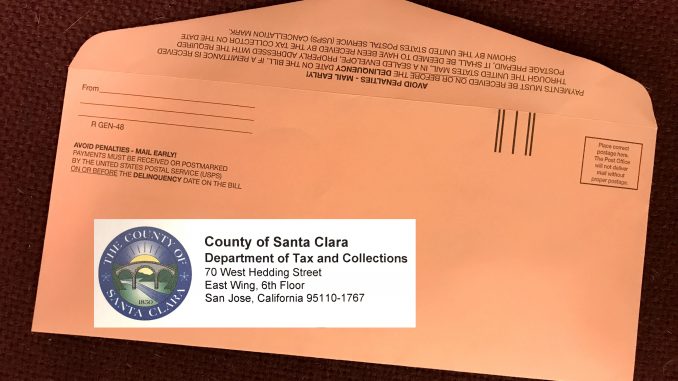

Include Block and Lot number on memo line. Property assessments performed by the Assessor are. East Wing 6 th Floor.

The Tax Collectors Office is open to the public from 900 AM - 500 PM Monday through Friday. 70 West Hedding Street. Enter Property Parcel Number APN.

Property Tax Payments can now be made via PayPal with an online service fee of 235 Beginning March 15 2022. You can get the information from the Assessors Office located at 70 West Hedding Street San Jose East Wing 5th Floor Monday through Friday between the hours of 800 am. Make checkmoney order payable to SF Tax Collector.

Property Tax Rates for Santa Clara County. Get In-Depth Property Tax Data In Minutes. County of Santa Clara COVID-19 Vaccine Information for the Public.

County Government Center East Wing 5th Floor 70 West Hedding Street San Jose CA 95110. Property Tax Rate Book. Closed on County Holidays.

The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence. Property Tax Distribution Charts. Business Property Statement Filing Period.

Property Taxes Santa Clara County Assessor Larry Stone. Ad Be Your Own Property Detective. Sunday Jul 24 2022 1145 PM PST.

Find Santa Clara County Online Property Taxes Info From 2021. Sales of secured roll information. Do not send cash.

Property tax billing questions. MondayFriday 900 am400 pm. Click here to register it now.

13936 Fremont Pines Lane. Search For Title Tax Pre-Foreclosure Info Today. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Currently you may research and print assessment information for individual parcels free of charge. Enter Property Address this is not your billing address. Save time - e-File your Business Property Statement.

The County of Santa Clara assumes no responsibility arising from use of this information. The Santa Clara County Assessors Office located in San Jose California determines the value of all taxable property in Santa Clara County CA. General Median Sale Price Median Property Tax Sales Foreclosures.

The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. Look up and pay your property taxes online. Sign up to receive home sales alerts in Santa Clara County Zip Code in Santa Clara County CA.

Click here to contact us. See property tax rates and equalized assessed values. Start Your Homeowner Search Today.

Pay Property Taxes. 1 2022 - May 9 2022. Property Records by Just Entering an Address.

See what your property tax dollars support. Ad Receive Santa Clara Cty. Last Payment accepted at 445 pm Phone Hours.

Some property andor parts thereof may be subject to a special exemptionsuch as those for veterans or non-profit organizations like churches or hospitals. Sunday Jul 24 2022 641 PM PST. The canceled checkmoney order stub serves as your receipt.

MondayFriday 800 am 500 pm. Last Day to file Business Property Statement without 10 Penalty. Send us a question or make a comment.

2022 County of Santa Clara. Office of the Treasurer Tax Collector. Enter Property Parcel Number APN.

The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the. View and pay for your property tax billsstatements in Santa Clara County online using this service.

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Industry News Invoke Tax Partners

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Tax Tax Assessor And Collector

Understanding California S Property Taxes

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Longtime Santa Clara County Assessor Looks To Be The Winner Again San Jose Spotlight

Info Santa Clara County Secured Property Tax Search

Scam Alert County Of Santa Clara California Facebook

Santa Clara County Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Property Taxes Department Of Tax And Collections County Of Santa Clara